OAN’s Brooke Mallory

6:28 PM – Thursday, August 10, 2023

According to a recent study, the city of Denver in Colorado has the fastest-growing inflation rate of any other city in the United States.

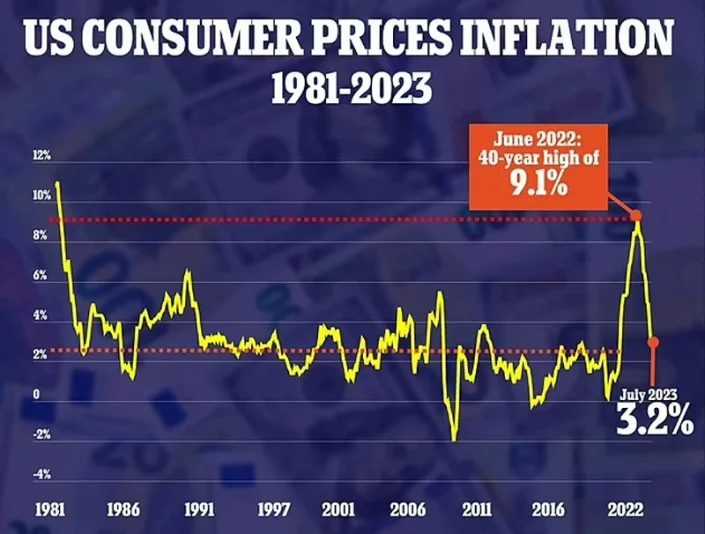

The annual inflation rate increased by 3.2% last month, up from 3% in June, according to the Bureau of Labor Statistics on Thursday.

Some cities did significantly worse than others statistically.

A survey conducted by WalletHub identified the top five American cities with the highest levels of inflation.

WalletHub is a personal finance website that offers free consumer tools that provide users with credit reports, credit scores, and credit monitoring. The company investigated how consumer expenses affect people in various cities and compared the performance of 23 major metropolitan statistical areas.

Denver’s annual inflation rate is 4.7%, which is more than a percentage point higher than the national average.

Atlanta, Detroit, and Seattle were all named among the top five cities having the worst inflation difficulties by researchers.

Anchorage, Alaska, on the other hand, was rated as having the “smallest” inflation. The city has a negative inflation rate of -3.3%, which has shifted during the previous two months.

Researchers also selected Washington, D.C., Boston, Chicago, and Minneapolis as having the “smallest” inflation concerns. These cities all had yearly inflation rates that were less than 3%.

Inflationary disparities across states are frequently caused by differences in their particular property markets.

Researchers in Denver, for example, suggested that the city’s high housing costs were fueling inflation.

“The housing component of DPI represents 44% of the overall basket and for the Denver-Aurora-Lakewood region, it went up 8.8% year over year versus 6.2% for the nation and 7.1% for the mountain region,” Brian Lewandowski of Leeds Business Research recently told CBS Colorado.

“That does demonstrate that we have more house price inflation than the rest of the country,” he continued.

It came after Florida was named the state with the highest inflation rate in a Bureau of Labor Statistics study last month. Analysts at the time attributed the high rate to Florida’s high home expenses.

“A lot of people are still coming to Florida because the economy is really strong, and many like the fact that we don’t have an income tax like in New York, for example… And in places like Miami, we’re seeing a lot of real estate demand from non-Floridians or non-American investors — generally wealthy folks who want to have a nice home here,” said Amanda Phalin, an economist at the University of Florida.

However, recent data shows that prices in Florida may finally be falling.

Despite annual rates of 5.9% and 6.9%, respectively, Tampa and Miami have had the fewest changes in pricing in the previous two months.

Annual inflation in the U.S. overall also rose to 3.2% in July. The Consumer Price Index advanced for the first time in 13 months.

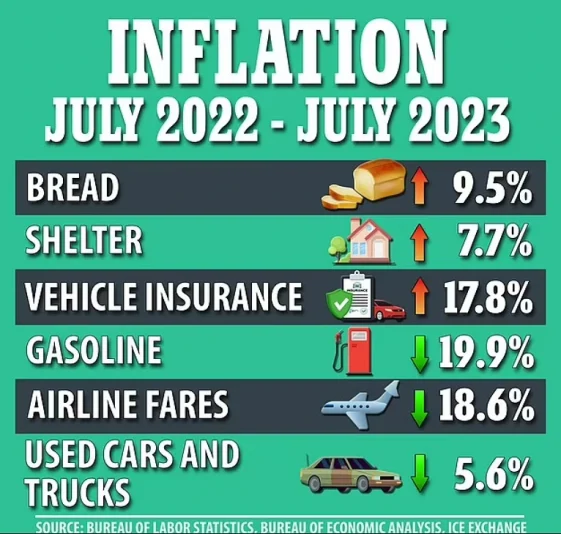

Prices increased 0.2% month over month in July, mostly due to increases in housing expenses like rent. According to the Bureau of Labor Statistics, this accounted for 90% of the monthly rise.

This slight monthly increase, however, is the same as in June, which may possibly prevent the Federal Reserve from hiking interest rates again in September.

The monthly rise was in line with projections, although the yearly rate was slightly lower than the 3.3% projected.

Stay informed! Receive breaking news blasts directly to your inbox for free. Subscribe here. https://www.oann.com/alerts