OAN’s Brooke Mallory

7:08 PM – Tuesday, May 30, 2023

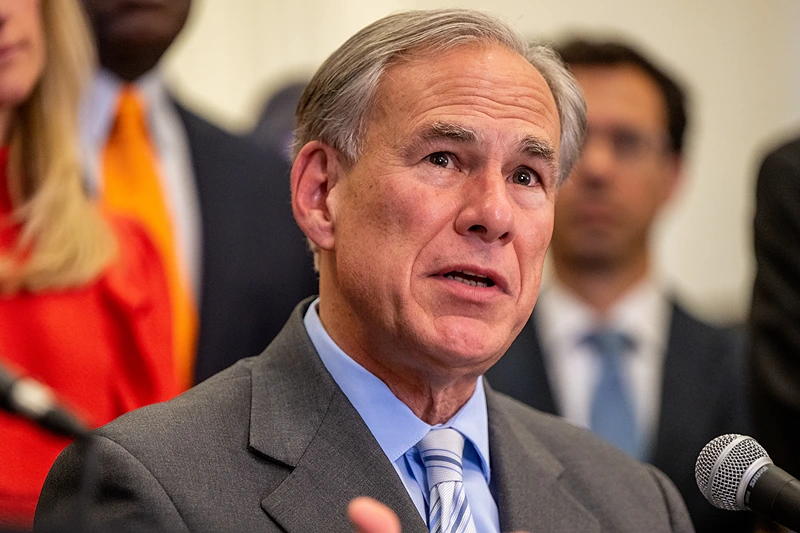

Just hours after lawmakers ended the year’s regular legislative session without enacting numerous key bills that state leaders had prioritized, Governor Greg Abbott called an urgent special session.

The special session’s formal start time was 9 p.m. on Monday, according to Abbott (R-Texas), and its main topics touched on border security and property tax relief. Abbott stated that there are still “many critical items that must be passed” and that this will necessitate several other special sessions.

Republican legislators had prioritized lowering property taxes for Texas homeowners and business owners with a significant portion of the state’s budget surplus. However, they were unable to come to an agreement.

The heads of both chambers had hinted in their closing remarks on Monday that lawmakers would likely be back at work on Tuesday.

“We must cut property taxes,” Abbott said in the statement. “During the regular session, we added $17.6 billion to cut property taxes. However, the legislature could not agree on how to allocate funds to accomplish this goal. Texans want and need a path towards eliminating property taxes. The best way to do that is to direct property tax reduction dollars to cut school property tax rates.”

Property tax reductions of $17.6 billion were included in the two-year budget proposal that Texas lawmakers approved this year. They would have had to pay $5.3 billion of that chunk for tax cuts since they committed to them in 2019.

The remaining $12.3 billion is intended for new cuts, according to legislators. By the time the normal legislative session finished on Monday, they had not managed to strike a consensus.

According to Abbott, the goal of the first special session will be to reduce property tax rates “solely by reducing the school district maximum compressed tax rate in order to provide lasting property-tax relief.”

The Texas governor is requesting that the $12.3 billion set aside for additional tax cuts be transferred to school districts so that they can reduce their tax rate. Under such a strategy, both homeowners and company owners would pay a much lower tax rate.

However, Lt. Governor Dan Patrick and Republican senators who support tax cuts have argued that these moves alone are not sufficient. Patrick and state Sen. Paul Bettencourt, a Republican from Houston and the principal author of the Senate’s tax-cut legislation, have worked to raise the state’s homestead exemption on school district taxes in an effort to give homeowners more immediate tax relief.

Patrick had rejected an Abbott-backed late-game proposal that did not contain an increase in the homestead exemption but was ostensibly supported by House Speaker Dade Phelan (R-Texas).

The agenda will also include “increasing or enhancing” the punishment for offenses involving operating a stash house or smuggling individuals.

A special legislative session can only be called by the governor.

Stay informed! Receive breaking news blasts directly to your inbox for free. Subscribe here. https://www.oann.com/alerts